The 8-Second Trick For Transaction Advisory Services

Wiki Article

The 25-Second Trick For Transaction Advisory Services

Table of ContentsTransaction Advisory Services for DummiesThe 45-Second Trick For Transaction Advisory ServicesThe Ultimate Guide To Transaction Advisory ServicesSome Known Facts About Transaction Advisory Services.Some Known Details About Transaction Advisory Services

This action makes certain the organization looks its best to possible customers. Obtaining the business's value right is essential for an effective sale.Deal advisors action in to help by obtaining all the needed details arranged, responding to questions from purchasers, and organizing visits to the organization's place. This builds trust with customers and keeps the sale relocating along. Getting the best terms is essential. Transaction experts use their competence to help company owner take care of hard negotiations, fulfill customer expectations, and framework deals that match the proprietor's goals.

Satisfying lawful regulations is critical in any type of service sale. Purchase advisory services function with lawful experts to produce and examine agreements, agreements, and various other lawful documents. This reduces dangers and ensures the sale follows the law. The function of transaction consultants expands past the sale. They assist entrepreneur in intending for their next actions, whether it's retired life, beginning a new endeavor, or handling their newly found wide range.

Purchase experts bring a wide range of experience and understanding, making sure that every facet of the sale is handled skillfully. Via critical preparation, evaluation, and settlement, TAS helps company owner accomplish the highest possible list price. By making sure legal and regulatory compliance and managing due persistance together with other deal employee, transaction advisors decrease possible dangers and liabilities.

Some Known Facts About Transaction Advisory Services.

By comparison, Large 4 TS groups: Service (e.g., when a possible purchaser is conducting due diligence, or when a bargain is closing and the customer needs to incorporate the business and re-value the vendor's Annual report). Are with costs that are not linked to the offer shutting effectively. Gain fees per involvement someplace in the, which is less than what financial investment banks gain even on "tiny deals" (yet the collection possibility is additionally much greater).

, yet they'll concentrate extra on accounting and appraisal and less on subjects like LBO modeling., and "accounting professional only" topics like test equilibriums and just how to stroll with occasions making use of debits and credit histories instead than monetary statement changes.

Top Guidelines Of Transaction Advisory Services

Specialists in the TS/ FDD groups may additionally talk to administration about every little thing over, and they'll write a detailed record with their searchings for at the end of the procedure., and the basic shape looks like this: The entry-level role, where you do a great deal of data and economic analysis (2 years for a promo from here). The following degree up; similar job, but you obtain the more fascinating little bits (3 years for a promotion).

In particular, it's hard to get advertised past the Manager degree since couple of individuals leave the job at that phase, and you require to start showing proof of your capacity to create revenue to development. Allow's start with the hours and way of living considering that those are easier to explain:. There are periodic our website late evenings and weekend work, however absolutely nothing like the agitated nature of financial investment banking.

There are cost-of-living changes, so expect reduced payment if you remain in a less expensive place outside significant monetary centers. For all positions except Partner, the base pay consists of the mass of the overall compensation; the year-end incentive may be a max of 30% of your base wage. Often, the most effective method to boost your incomes is to change to a different firm and bargain for a greater income and bonus offer

5 Easy Facts About Transaction Advisory Services Shown

At this stage, you should simply remain and make a run for a Partner-level duty. If you desire to leave, maybe relocate to a client and do their assessments and due diligence in-house.The primary problem is that since: You usually require to sign up with one more Large 4 team, such as audit, and work there for a couple of years and after that relocate into TS, work there for a couple of years and after that relocate into IB. And there's still no guarantee of winning this IB role since it depends on your region, customers, and the hiring market at the time.

Longer-term, there is look at these guys also some risk of and because evaluating a firm's historic economic info is not precisely brain surgery. Yes, humans will certainly constantly need to be entailed, but with advanced technology, reduced head counts might possibly sustain client involvements. That said, the Deal Providers team beats audit in terms of pay, job, and leave chances.

If you liked this post, you could be thinking about reading.

The Basic Principles Of Transaction Advisory Services

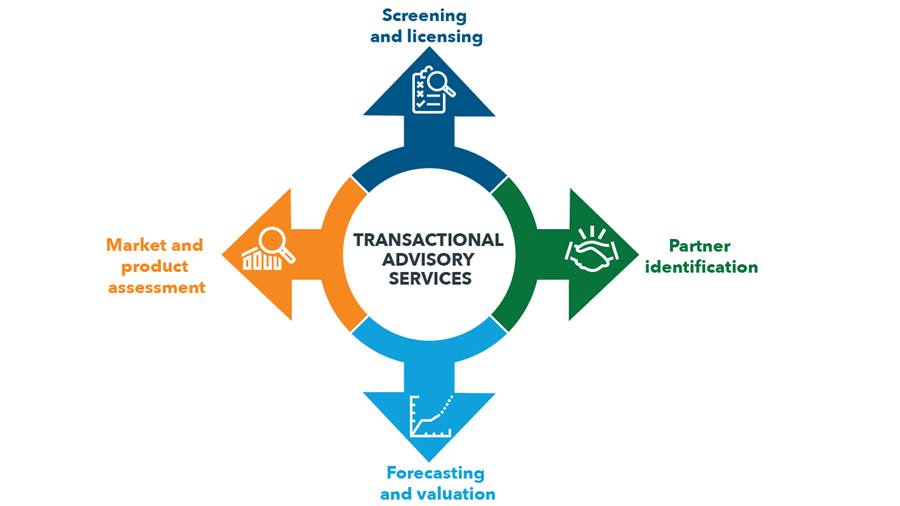

Develop sophisticated economic structures that assist in establishing the actual market worth of a firm. Give consultatory operate in connection to organization assessment to help in negotiating and pricing frameworks. Describe the most suitable form of the deal and the kind of factor to consider to use (cash money, stock, earn out, and others).

Carry out assimilation planning to figure out the process, system, and organizational adjustments that may be required after the offer. Set guidelines for incorporating departments, innovations, and organization procedures.

Determine prospective decreases by minimizing DPO, DIO, and DSO. Examine the prospective client base, market verticals, and sales cycle. Think about the possibilities for both cross-selling and look at here now up-selling (Transaction Advisory Services). The operational due diligence offers vital insights into the performance of the firm to be gotten worrying risk analysis and value production. Recognize short-term adjustments to financial resources, banks, and systems.

Report this wiki page